ASML Holding NV Stock Rises Amid Legal Issues

ASML stock increased by 1% in premarket trading after a Dutch court extended the detention of a former employee suspected of stealing intellectual property and selling it to Russian buyers. Despite this, technical analysis shows that the stock price is currently range-bound.

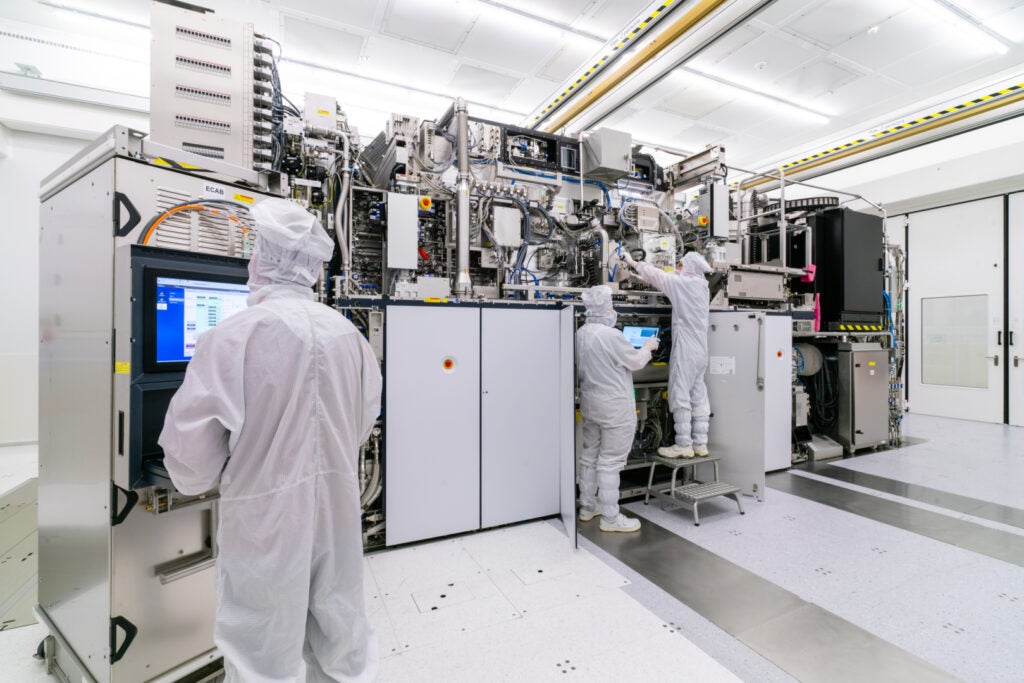

Suspected Theft of Intellectual Property

The 43-year-old man accused of stealing proprietary design manuals related to microchips and military-grade technology from ASML, Mapper, NXP, and the Delft University of Technology has denied all charges. The prosecutors have requested an extension of his detention until February, citing the risk of flight and further leaks.

Stock Performance and Technical Analysis

ASML Holding’s shares have declined 1.45% year-to-date and 32.18% in the last six months. However, technical analysis using daily moving averages suggests a period of consolidation.

In premarket trading, the stock was above its eight and 20-day moving averages but below the 50 and 200-day moving averages. This indicates near-term upward momentum but overall consolidation. The relative strength index of 54.09 suggests the stock is in a neutral region.

Analyst Price Targets

According to analysts, ASML has a consensus price target of $870 per share. The highest price target is $1,148 per share, while the average price target implies an 11.9% upside from the current price of the stock.

Overall, despite the legal issues, ASML Holding NV stock shows potential for growth according to analysts.

Source : www.benzinga.com