Bank of Japan Governor Tacks Toward Normalcy with Latest Moves

Bank of Japan Governor Kazuo Ueda has taken significant steps to guide the central bank towards a more orthodox stance by increasing rates and cutting bond purchases. The recent rate hike to 0.25% marks the highest level borrowing costs have seen in Japan since December 2008. Ueda has been clear that rates will continue to rise if price forecasts align with expectations.

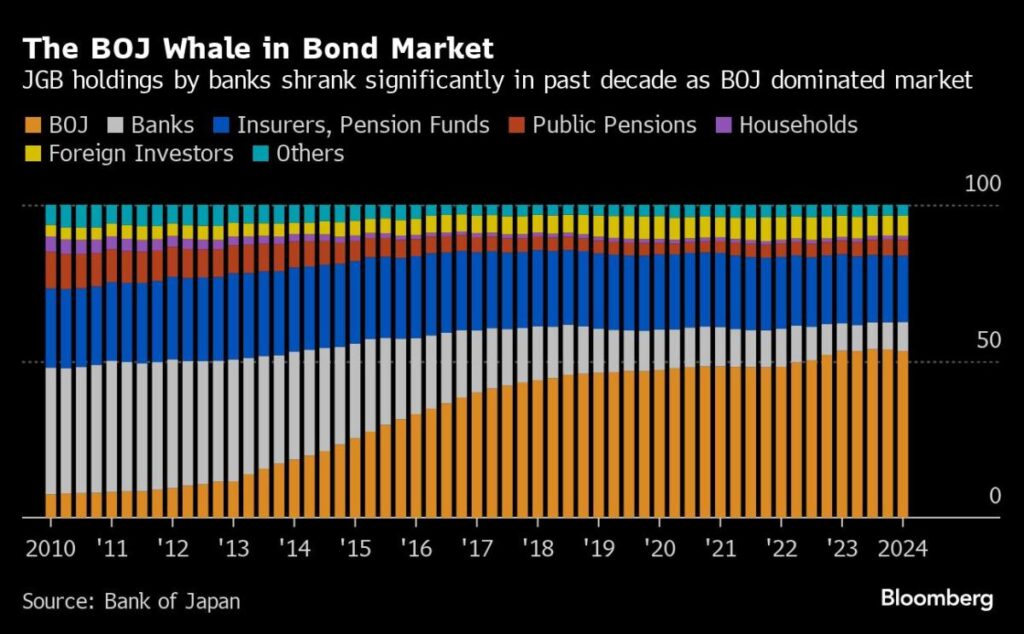

The move signals Ueda’s commitment to dismantling the central bank’s elaborate stimulus program, with the aim of normalization. The Bank has already abandoned its control of bond yields and negative interest rates earlier this year.

Implications of the BOJ’s Actions

Following the recent developments, analysts are forecasting further rate hikes in the coming year. The yen has already shown signs of strengthening against the dollar, impacting exporters and potentially reversing inflationary trends.

As Japan’s economy undergoes this transition, there are concerns about the impact on wage growth, inflation, and overall economic stability. The central bank’s decisions could have far-reaching effects on both domestic and international markets.

Challenges and Opportunities Ahead

While Prime Minister Fumio Kishida faces challenges related to inflation and exchange rates, the BOJ is poised to continue its normalization efforts. The economy’s ability to adapt to rising rates and changing policy directions remains a key uncertainty.

Despite the potential risks, some observers view Japan’s shift towards monetary policy normalization as a positive step towards a more balanced economic structure. The coming months will be crucial in determining the success of these initiatives.

Source : finance.yahoo.com