Bitcoin Halving: Understanding the Science Behind the Phenomenon

Bitcoin has recently hit a new all-time high of USD 106,000, setting a new record in the cryptocurrency world. One of the key factors contributing to this surge in price is the Bitcoin Halving event that occurred in April 2024. Let’s explore what Bitcoin Halving is and how it influences the future of this digital currency.

What is Bitcoin Halving?

Bitcoin was designed to have a limited supply of 21 million tokens from the beginning. The concept of halving, built into Bitcoin’s code, works by reducing the rate at which new coins are introduced into circulation. This event does not decrease the total number of Bitcoins in circulation, but rather halves the reward given to miners for validating transactions, known as « halving. »

The Science Behind Bitcoin Halving

Bitcoin operates on Blockchain technology, creating blocks of information through a process called mining, where miners are rewarded for validating transactions. Every 210,000 blocks added to the blockchain trigger a halving event, occurring approximately every 4 years. Miners then receive only half the Bitcoin reward for each block added.

This reward mechanism prevents fraudulent transactions, controls inflation, and maintains Bitcoin’s limited supply. With around 19.5 million Bitcoins already mined and a max supply of 21 million, future halving events will continue until the last Bitcoin is mined around 2140, ensuring minimal inflation over the next century.

Market Dynamics: Implications of Halving

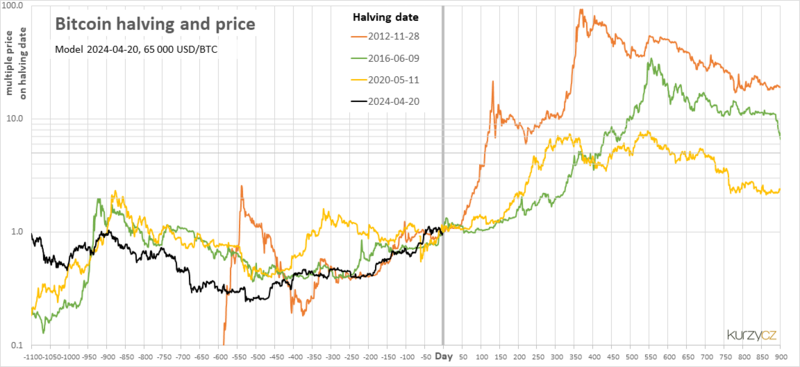

There have been four halving events historically, each leading to a surge in Bitcoin’s market value. The reduction in mining rewards aims to preserve Bitcoin’s value and scarcity, stimulating market growth. However, concerns arise regarding mining profitability, potential 51% attacks, and environmental impact.

While halving events may impact mining costs, they also incentivize miners to adopt energy-efficient techniques, reducing overall energy consumption. Recent halving events have not always resulted in immediate price surges, influenced by factors like interest rates, inflation, and market conditions.

As Bitcoin breaks price records and surpasses USD 100,000, the possibility of reaching USD 1 million remains speculative but plausible. The cryptocurrency’s resilience and market dynamics continue to shape its future as it navigates the complexities of a volatile landscape.

Source : www.sify.com