Bitcoin prices rebound thanks to ETF inflows

Bitcoin prices have bounced back after a streak of outflows, with ETF inflows increasing and reaching a significant amount on September 10. This influx of funds has helped push prices higher, breaking the trend of recent days.

BlackRock issues warning on market volatility

BlackRock, the world’s largest asset manager, has highlighted concerns about continued market volatility. Factors such as recession fears, anxiety around the US election, and investor sell-offs contribute to this instability.

Decreased investor engagement in Bitcoin and Ethereum

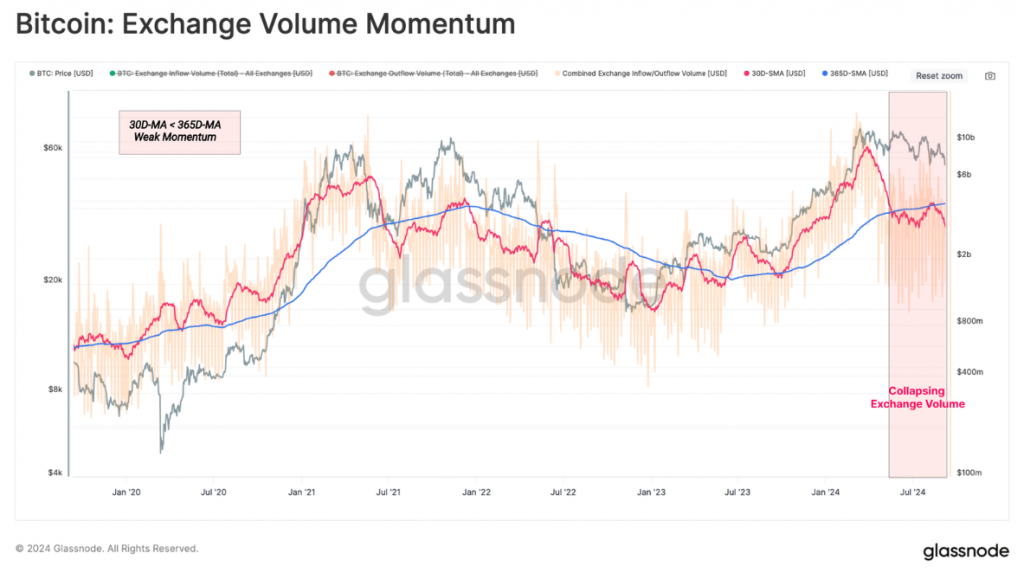

On-chain data analysis shows a decline in investor engagement and trading volumes in both Bitcoin and Ethereum. This reduced interest in trading activities indicates a lack of conviction among investors within the current price range.

Source: SoSo Value (click to enlarge)

Looking at the data from Glassnode, we see that trading volumes have decreased significantly, reflecting a decline in investor demand. The monthly average volume is notably lower than the yearly average, indicating a lack of interest in trading activities.

Source: Glassnode (click to enlarge)

Bitcoin ETFs experiencing outflows

Both Bitcoin and Ethereum ETFs are seeing outflows, but the interest in Bitcoin ETFs remains significantly higher. Despite recent outflows, the impact of the Bitcoin ETF on the crypto market has been substantial, according to recent analysis by Chainalysis.

Chainalysis reports that the launch of the Bitcoin ETF in the US has led to increased crypto transactions globally, surpassing milestone levels during the 2021 bull run. This indicates a strong impact on the cryptocurrency market as a whole.

US Presidential Race and Debate Impact

The recent US Presidential debate did not address Bitcoin, despite significant spending by the crypto lobby on the election. The contrasting views of candidates Trump and Harris on crypto suggest potential future volatility in the market as the election date approaches.

Technical Analysis and Market Outlook

Bitcoin prices have fluctuated recently but seem to be holding above key support levels. The daily close will provide insight into future price action, with a bullish close indicating potential upside and a bearish close suggesting a pullback.

Source: TradingView.com (click to enlarge)

Overall, market participants are cautious, with a range trading strategy in place as they wait for clearer market direction. The on-chain data supports this view, with trading volume reflecting the current lack of conviction among investors.

Source : www.marketpulse.com