Flash PMIs from Europe, Asia, and the US

The general theme for flash PMIs from Europe, Asia, and the US on Monday was that manufacturing contracted faster than expected while services expanded at a faster pace. But it was the US services flash PMI that came out on top, rising to a 38-month high of 58.5. Firm’s expectations for output over the next year were also higher, thanks to growth optimism amid a new Trump administration. That this comes on the eve of the last FOMC meeting of the year serves as a fresh reminder that the US economy remains stronger, shows the potential to remain strong. And with that can come more inflation and a less dovish Fed.

US Stock Market Update

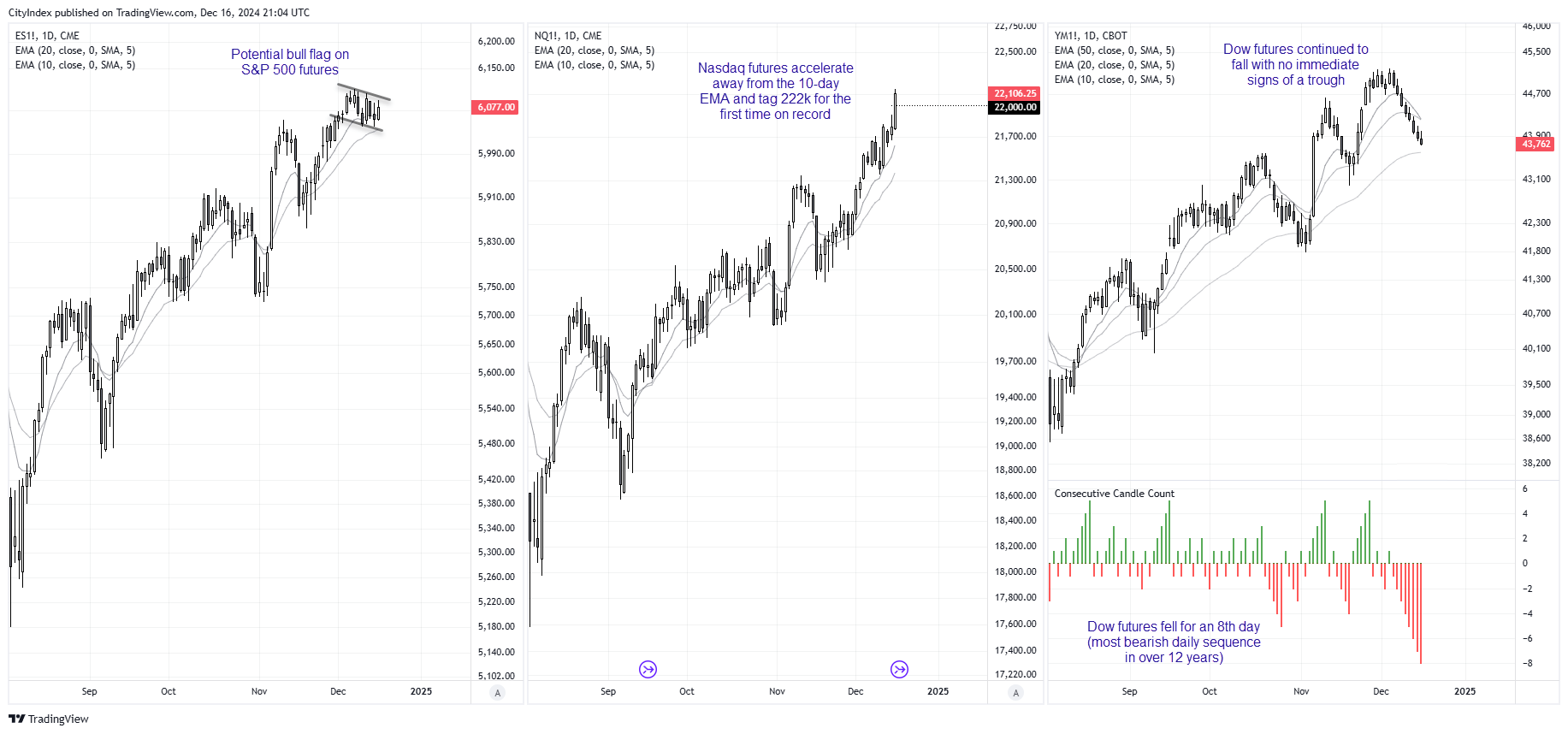

Still, the three major US indices are simply not on the same page at the moment. The Nasdaq 100 surged to its latest record high on Monday, with the front-month futures contract tapping 22k for its first time in history. Prices are accelerating away from the 10 and 20-day EMAs with an extra show of confidence.

While the S&P 500 also traded higher, it remains stuck in a sideways consolidation just off its record high. The trend is clearly bullish, but it is not ready to resume its trend ahead of this week’s FOMC meeting. Still, it is holding above its 20-day EMA and closed above the 10-day EMA.

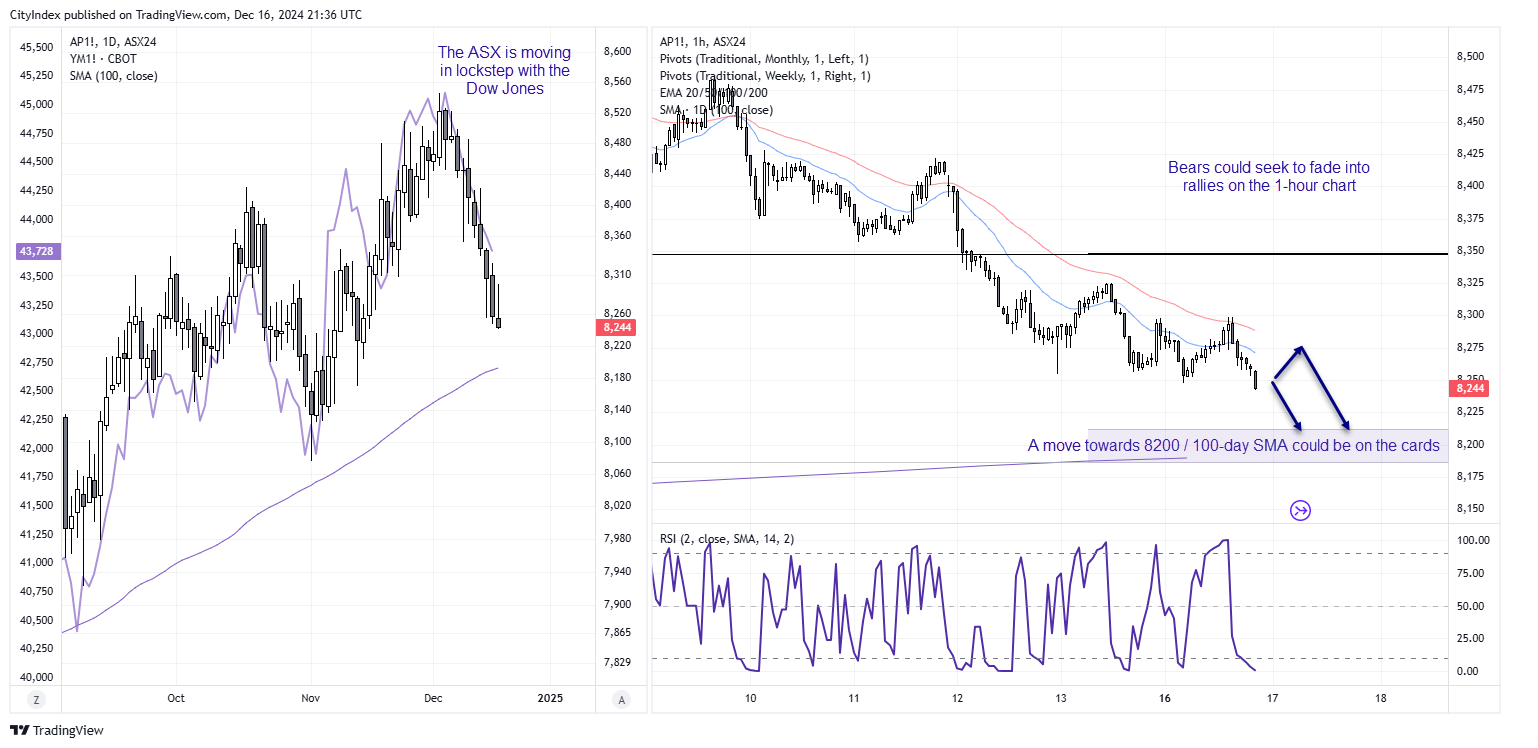

Meanwhile, Dow Jones futures were lower for an eight consecutive day which marks its most bearish daily sequence since August 2011. Now sitting at a 3-week low, it isn’t showing any obvious signs of trough yet. And given the ASX 200 is tracking the Dow more closely than the S&P at present, that should concern ASX bulls.

ASX 200 Futures Technical Analysis

The daily chart on the left shows the strong correlation between the Dow Jones and ASX 200 at present. It seems the ASX wants to retest its 100-day EMA (8192). And with such a strong bearish trend on the 1-hour chart, bears could seek to fade into moves towards the 10n or 20-day hour EMA in anticipation of a move lower to the 8200 handle.

Economic Events in Focus (AEDT)

10:30 – AU consumer sentiment (Westpac)

11:00 – NZ economic forecast, budget balance, debt forecast (NZ Treasury)

11:30 – SG non-oil exports

18:00 – UK earnings, claimant count, employment change, unemployment rate

20:00 – DE Ifo business sentiment

21:00 – EU and DE ZEW economic sentiment

00:30 – US retail sales

00:30 – CA CPI

01:15 – US industrial production, manufacturing production, capacity utilization

View the full economic calendar

— Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

Source : www.forex.com