Mutual Funds DODGX and OAKMX for Current Market Environment

A pair of longstanding, actively managed, value-oriented mutual funds, DODGX and OAKMX, appear to be well-positioned for the current market environment. Tech and growth stocks have experienced a significant sell-off this summer, while defensive value stocks are holding their ground. This market rotation highlights the importance of maintaining a diversified portfolio.

Dodge & Cox Stock Fund (DODGX)

DODGX is a popular mutual fund that invests in undervalued large-cap and mid-cap U.S. stocks. The fund’s portfolio is attractively priced compared to the broader market, with a focus on long-term growth. DODGX holds a mix of tech, growth, and value stocks, including top performers like Alphabet, Microsoft, Wells Fargo, and Fiserv. The fund also offers an attractive dividend yield and requires a minimum investment of $2,500.

Is DODGX Stock a Buy, According to Analysts?

Wall Street analysts have given DODGX a Moderate Buy consensus rating, citing its potential for upside growth. The average stock price target for DODGX implies a 16.4% increase from current levels.

Oakmark Fund (OAKMX)

OAKMX is a diversified fund that focuses on long-term capital appreciation by investing in larger U.S. companies. The fund’s holdings are attractively priced, with a lower average price-to-earnings multiple compared to the market. OAKMX holds a mix of tech, growth, and value stocks, including top holdings like Alphabet, Citigroup, and Wells Fargo. The fund pays a dividend and features an expense ratio of 0.91%.

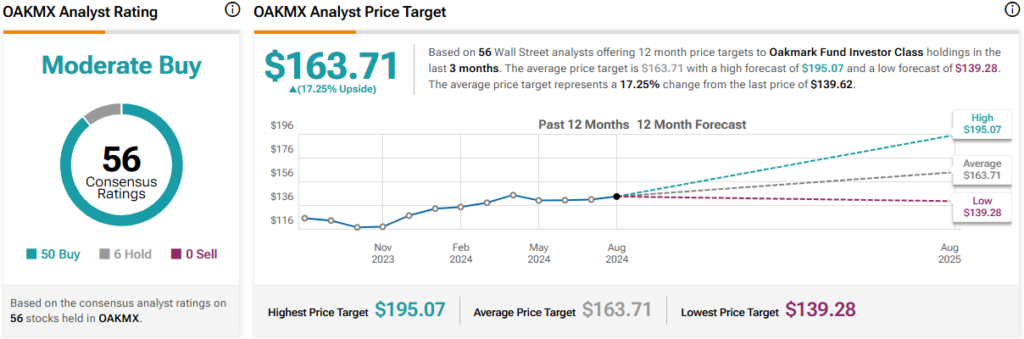

Is OAKMX Stock a Buy, According to Analysts?

Analysts have given OAKMX a Moderate Buy consensus rating, with an average stock price target that implies a 17.25% potential upside from current levels.

Investor Takeaway

Both DODGX and OAKMX offer well-rounded, actively managed portfolios that combine tech, growth, and value stocks. With attractive valuations and strong potential for growth, these mutual funds provide investors with a diversified approach to navigating the current market landscape.

Source : www.tipranks.com