EUR/USD rises with ECB rate decision & US CPI data due this week

EUR/USD is gaining momentum as investors turn their focus to the European Central Bank (ECB) rate decision and US Consumer Price Index (CPI) data scheduled for this week.

ECB rate decision expected to cut rates by 25 bps

The ECB is anticipated to reduce rates by 25 basis points on Thursday in response to concerns over inflation risks in the Eurozone. Recent data has highlighted a weaker economic outlook, with PMI data declining and the French economy facing challenges after a government collapse.

US CPI data projected to rise to 2.7%

On Wednesday, the US CPI is forecasted to increase to 2.7% in November, up from 2.6%. The market is also pricing in an 80% chance of a 25 basis point rate cut next week, following recent comments from Federal Reserve Chair Jerome Powell.

EUR/USD forecast – technical analysis

EUR/USD has rebounded from recent lows and is now consolidating between 1.050 and 1.060. The price has surpassed the 20 SMA, indicating a positive trend towards 1.07. However, a failure to sustain levels above 1.06 could lead to a retreat towards 1.05 and potentially 1.0450.

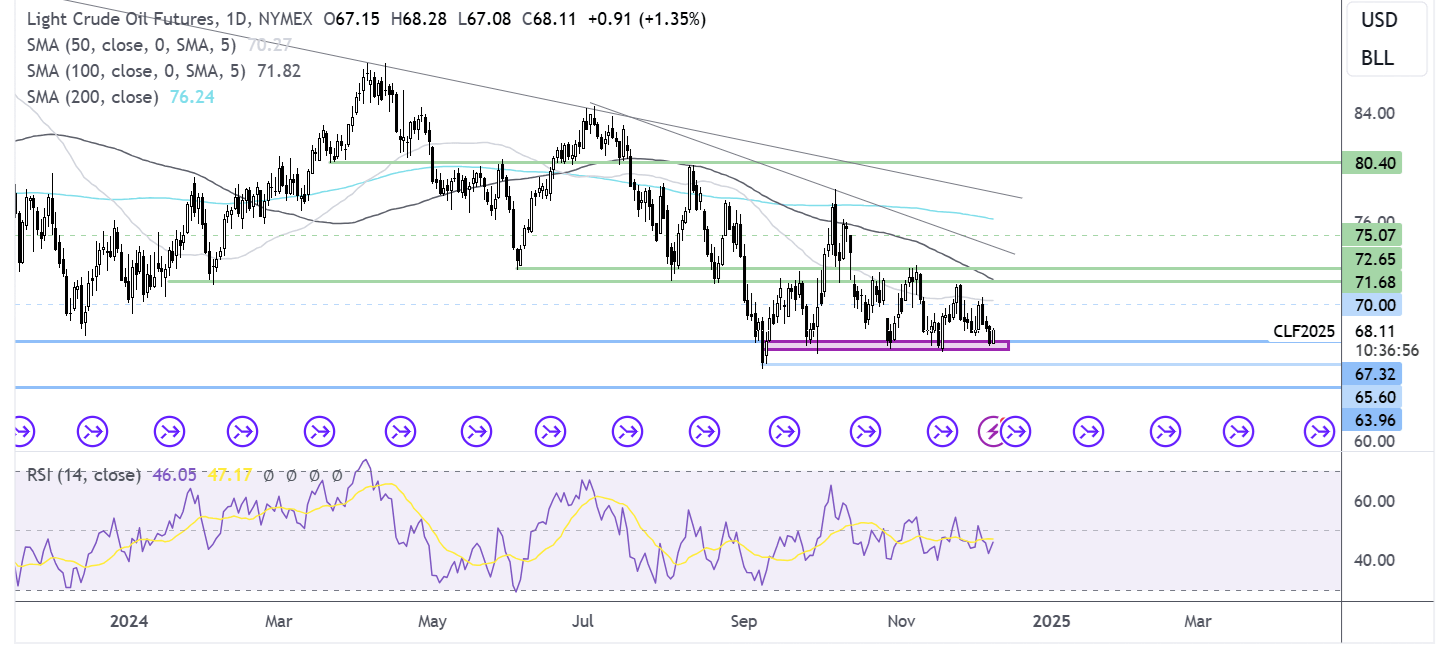

Oil prices rise on China’s looser policy stance

Oil prices climbed by 1% on Monday following China’s shift towards a more relaxed monetary policy to boost growth. The easing stance in China, coupled with geopolitical uncertainty after the fall of Syrian President Bashar al-Assad, are supporting oil prices. Saudi Aramco also reduced prices for Asian buyers, signaling market conditions.

Oil price forecast

Oil is trading within a range, with resistance at 71.50 – 72.50 and support at 67-67.50. To continue its upward trajectory, oil needs to surpass the 71.50 level, while a breach of 67.50 could lead to further downside towards 65.25 and 63.60.

Source : www.forex.com