EUR/USD rises but the outlook remains weak

EUR/USD continues to climb after recent losses, with the market closely monitoring developments in France and upcoming U.S. economic data releases.

Political Uncertainty in France

The French government faces potential collapse, leading to increased political uncertainty in Europe. Coupled with weak economic data, particularly in the manufacturing sector, the Euro’s outlook remains bearish.

US Dollar Trends

On the other hand, the US dollar is experiencing slight weakness, despite seasonal trends. President Trump’s support for a stronger dollar may impact market expectations.

Upcoming Economic Data

This week, the market looks forward to key U.S. economic figures like JOLTS job openings, ADP payrolls, ISM services PMI, and the non-farm payroll report. Positive data could influence rate cut expectations.

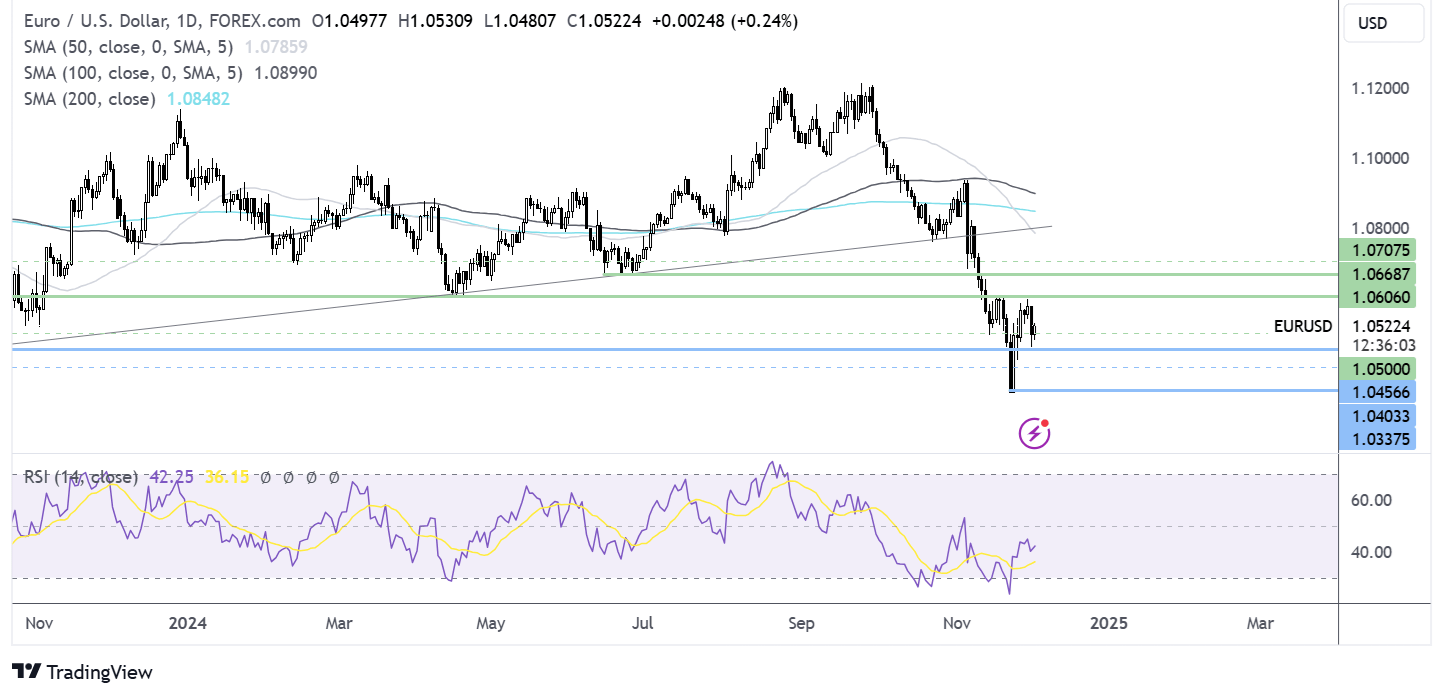

EUR/USD Forecast – Technical Analysis

EUR/USD is currently trading between resistance at 1.06 and support at 1.0460. The RSI and SMAs indicate a bearish trend, with potential for further downside if support is broken.

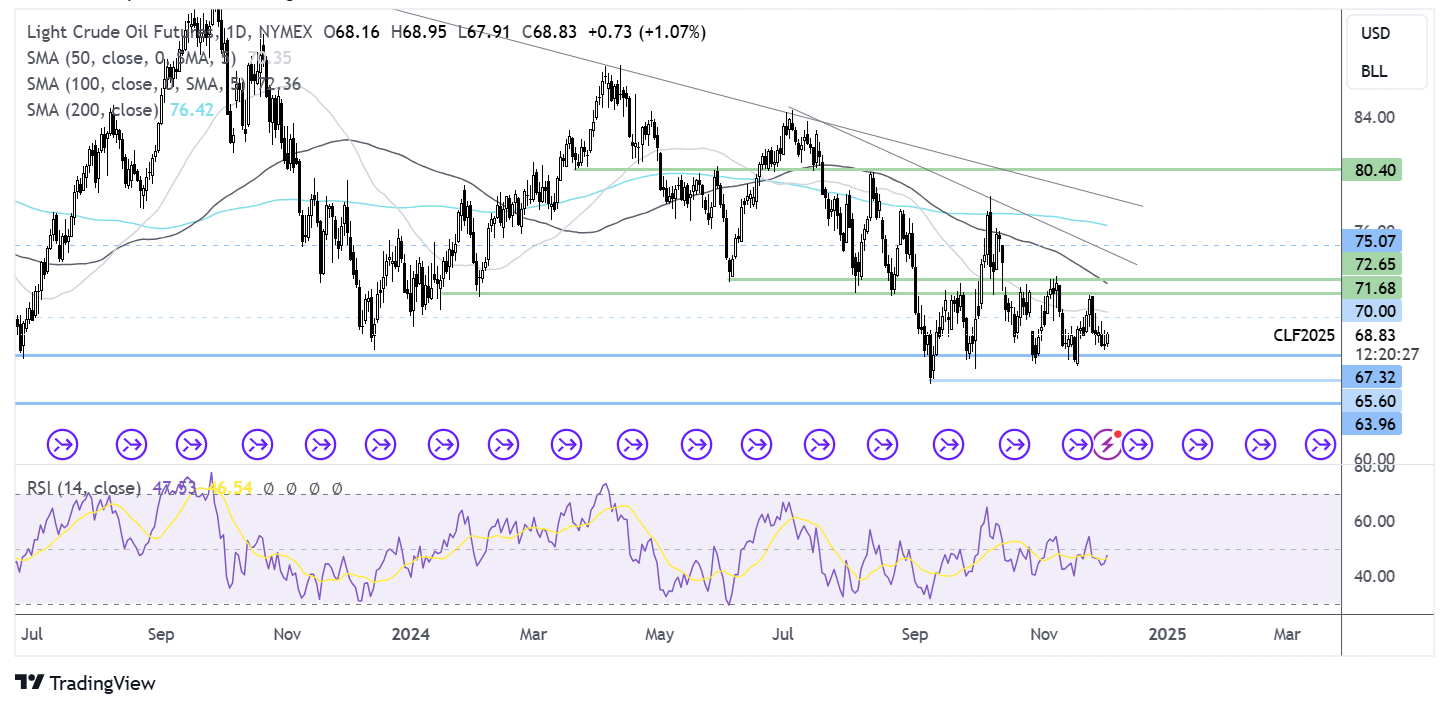

Oil Prices on the Rise

Oil prices are increasing ahead of the OPEC meeting, with expectations of production cut extensions. Positive Chinese data supports demand outlook, despite geopolitical tensions and Fed rate cut uncertainties.

Upcoming Inventory Data

Investors await US crude stockpiles and OPEC decision on production cuts. Technical analysis shows oil trading within a familiar range, with potential for breakout based on supply-demand dynamics.

Source : www.forex.com