EUR/USD maintains above 1.08 amidst French political uncertainty & ahead of Powell’s testimony

EUR/USD is currently trading above 1.08 as investors analyze the recent French election outcome and anticipate Jerome Powell’s testimony before Congress later today.

French election results impact EUR/USD

The French elections led to a hung parliament, which could potentially restrict gains in the EUR. With the New Popular Front winning without an absolute majority, France is now faced with a hung parliament situation.

The left New Popular Front secured 178 seats out of 577, granting them the opportunity to form a government. Despite the uncertainty, political gridlock might actually limit excessive spending and maintain debt levels in check for France.

However, this political deadlock could also curb the upward potential of the EUR in the near future.

Influence of Powell’s testimony on EUR/USD

The US dollar is hovering near a monthly low awaiting clarity from Jerome Powell regarding future interest rate decisions. Following recent weak economic data, there is a 76% chance of a rate cut in September, up from 66% the previous week.

Powell’s statements during his Congress testimony will be pivotal in determining the likelihood of a rate cut. Additionally, upcoming inflation data will provide further insight into the Fed’s monetary policy direction, particularly with regards to a potential rate cut towards the end of summer.

EUR/USD technical analysis

EUR/USD has surpassed its 200 SMA, indicating a bullish trend, but faces resistance at 1.0840. To target the June high of 1.0915, the price level must exceed this resistance point.

Immediate support lies at 1.0785, the 200 SMA. If this level is breached, the next support levels are at 1.07, which marks the February low and the critical trendline support.

GBP/USD stability post UK election & BoE Haskel’s caution

Trading around 1.28, GBP/USD remains steady despite the recent UK election results, demonstrating a business-friendly outlook with Labour leaders in key positions. Attention now shifts to monetary policy in the UK and the US.

Bank of England policymaker Jonathan Haskel has expressed reservations about reducing interest rates given persistent inflationary pressures within the labor market. Despite market expectations of a rate cut in August, Haskel maintains a cautious stance towards monetary policy.

Inflation in the UK, though moderating slightly, remains elevated in the service sector and wage growth is stagnant. Policymakers are likely to wait for further easing of these pressures before considering a rate cut.

No major UK economic data is scheduled for release today, with focus on Jerome Powell’s address to Congress. Any dovish commentary could potentially affect GBP/USD movements.

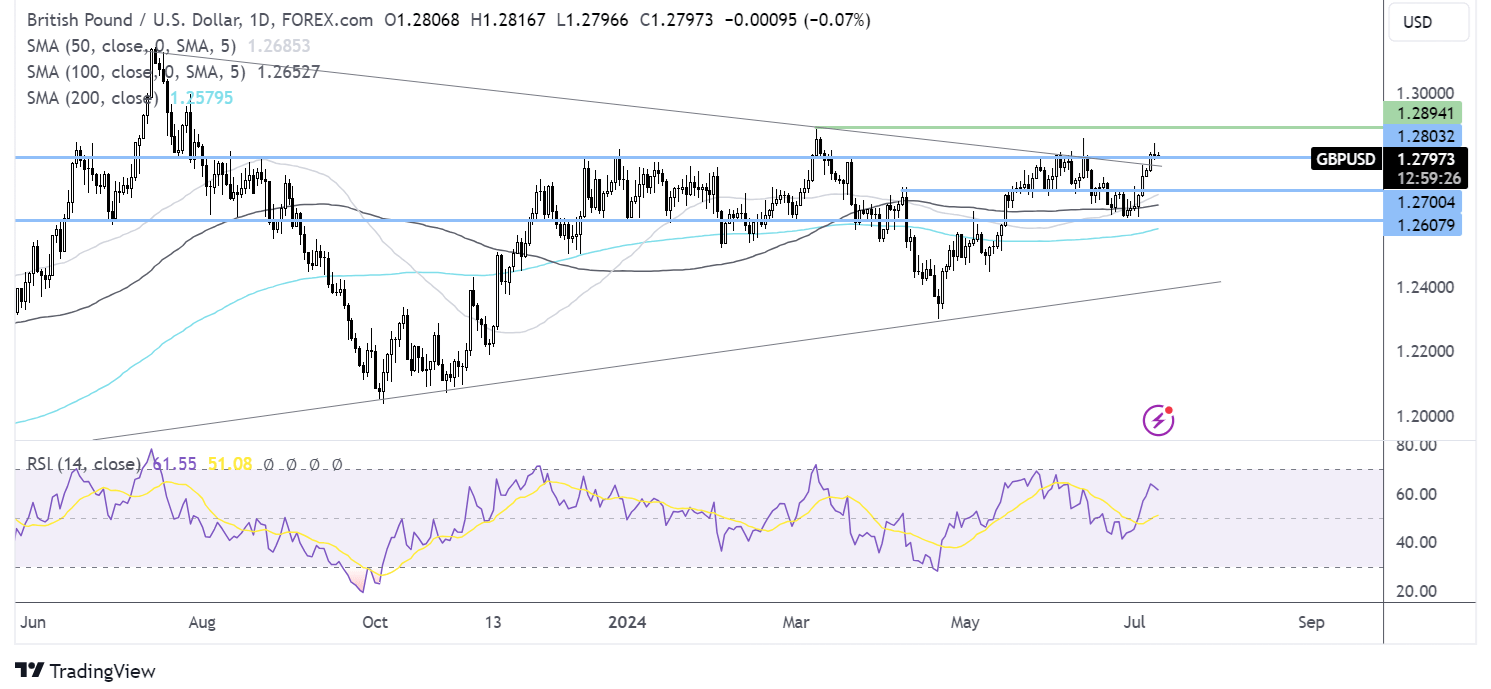

GBP/USD technical analysis

GBP/USD is striving to surpass the descending trendline from July last year and the 1.28 level. Breaching this barrier would bring the 2024 high of 1.2894 into focus.

Initial support is at 1.2780, the trendline support. A breakdown below this level could lead to a further decline towards the 1.27 mark.

Source : www.cityindex.com