Wall Street indexes paused after Wednesdays rally as Core PPI came in hot

Today, the major Wall Street indexes have taken a breather following a significant rally on Wednesday. The Core Producer Price Index (PPI) print has come in hotter than expected, leading to a pause in the market’s upward movement. Many investment banks and analysts have been warning that rate cuts may not be as aggressive as anticipated, and the recent data release seems to confirm this sentiment.

Moderna Shares Plunge 17.8% due to lower-than-expected sales projections

Shares of Moderna, symbol MRNA, plummeted by 17.8% today, hitting their lowest point since November during intraday trading. This steep decline was prompted by the company’s sales projection for the upcoming year, which fell below analysts’ expectations. The market reaction to Moderna’s announcement has been significant, making it the top loser on the S&P 500 today.

Nasdaq 100 Shows Potential for Upward Movement, But Technical Hurdles Persist

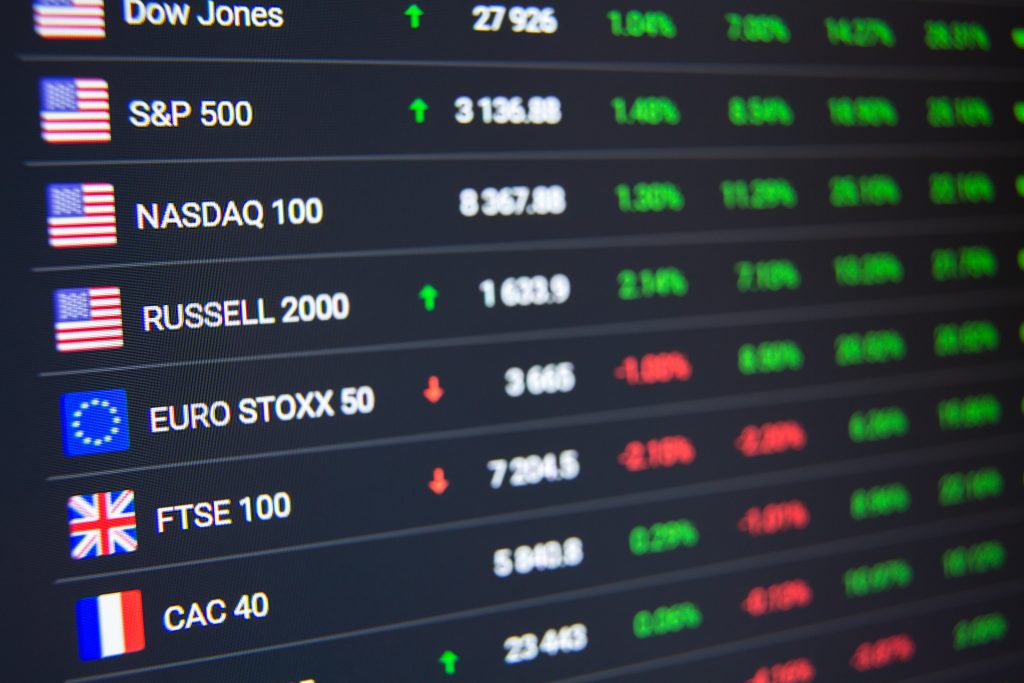

Despite potential for upward movement, the Nasdaq 100 faces technical challenges that are impeding its progress. The recent rally in tech stocks, which led to gains in the Nasdaq 100 and S&P 500, has slightly slowed down today. The market is now more cautious as it anticipates the Federal Reserve’s next move, with a 77% likelihood of a 25 bps rate cut next week.

Technical Analysis of the Nasdaq 100

From a technical perspective, the Nasdaq 100 has seen a strong performance this week, with four consecutive days of gains. However, there are obstacles ahead, including a descending trendline and previous resistance levels that the index needs to overcome to continue its upward trajectory. Despite the recent bullish streak, caution is advised as the Relative Strength Index (RSI) suggests further potential upside, but a similar pattern to a previous rally could be forming.

Overall, the market sentiment is cautious as investors assess the impact of recent economic data releases and anticipate the Fed’s next move. Tech stocks continue to play a significant role in market movements, with potential for both gains and challenges ahead for major indexes.

Source : www.marketpulse.com